.webp)

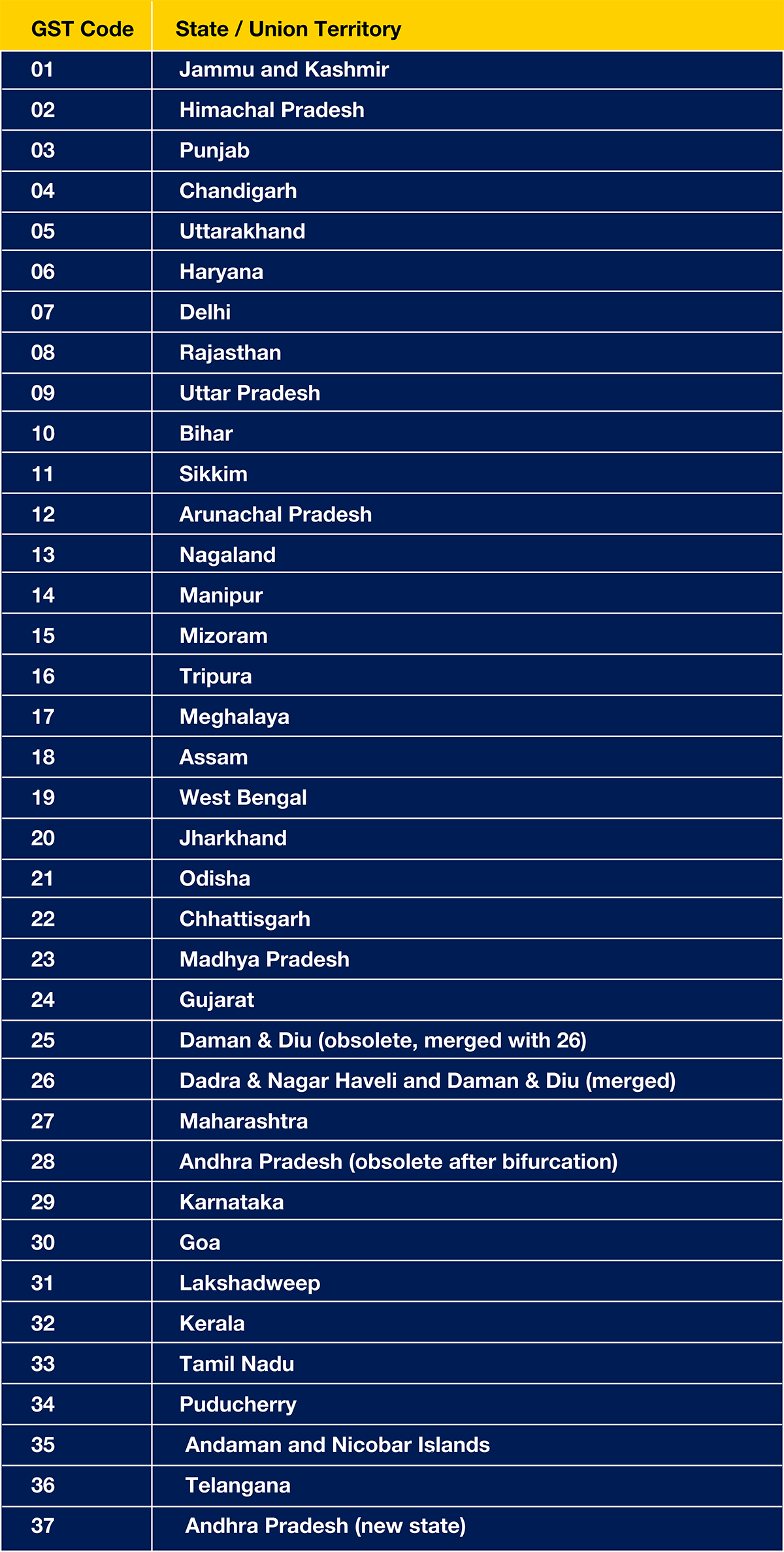

Understanding the GST code for Indian states is essential for anyone dealing with GST compliance, invoicing, and registration in India. Each state and union territory is assigned a unique two-digit GST code that forms the beginning of every GSTIN (Goods and Services Tax Identification Number). For instance, the GST code for Maharashtra is 27, while for Karnataka, it is 29. These codes help in identifying the location of the taxpayer and streamlining tax administration across regions. Whether you're a business owner or a tax professional, knowing the GST codes for Indian states simplifies compliance and improves accuracy in GST filings.

| GST Code | State / Union Territory |

|---|---|

| 01 | Jammu and Kashmir |

| 02 | Himachal Pradesh |

| 03 | Punjab |

| 04 | Chandigarh |

| 05 | Uttarakhand |

| 06 | Haryana |

| 07 | Delhi |

| 08 | Rajasthan |

| 09 | Uttar Pradesh |

| 10 | Bihar |

| 11 | Sikkim |

| 12 | Arunachal Pradesh |

| 13 | Nagaland |

| 14 | Manipur |

| 15 | Mizoram |

| 16 | Tripura |

| 17 | Meghalaya |

| 18 | Assam |

| 19 | West Bengal |

| 20 | Jharkhand |

| 21 | Odisha |

| 22 | Chhattisgarh |

| 23 | Madhya Pradesh |

| 24 | Gujarat |

| 25 | Daman & Diu (obsolete, merged with 26) |

| 26 | Dadra & Nagar Haveli and Daman & Diu (merged) |

| 27 | Maharashtra |

| 28 | Andhra Pradesh (obsolete after bifurcation) |

| 29 | Karnataka |

| 30 | Goa |

| 31 | Lakshadweep |

| 32 | Kerala |

| 33 | Tamil Nadu |

| 34 | Puducherry |

| 35 | Andaman and Nicobar Islands |

| 36 | Telangana |

| 37 | Andhra Pradesh (new state) |

JAIN PU College, a part of the renowned JGI Group, is committed to empowering students with quality education.

Beyond academics, the college ensures its online content reflects the same standard of excellence. Every blog and article is meticulously vetted and proofread by subject matter experts to ensure accuracy, relevance, and clarity. From insightful educational topics to engaging discussions, JAIN PU College's content is crafted to inform, inspire, and add value to its readers, reflecting the institution's commitment to intellectual growth and innovation.

View all Blogs